Very few people think about the safe way of making financial transactions when online. Some connect to public WiFi and purchase items on Amazon or do online banking. Such behavior exposes you to many risks and it makes it easy for others to steal your financial data like your credit card details and use it to harm you. That's why we decided to write this guide in which we will show you the best practices for making safe financial transactions when online, both on desktop computers and mobile devices like smartphones and tablets. Let's get started:

How to perform financial transactions from a computer connected to a trusted network

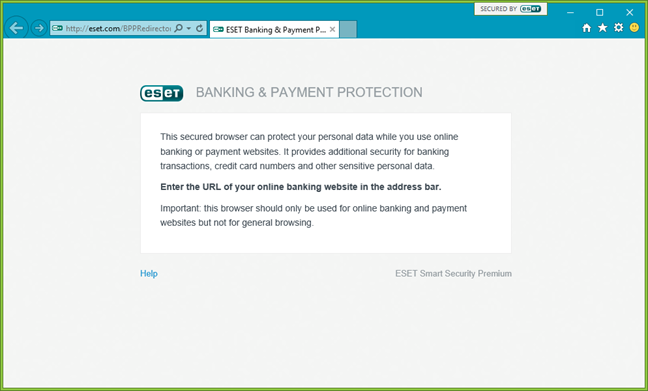

If you are connected to a trusted network such as the one from your home or from your workplace, then you don't need anything else except having a solid security solution installed and active at all times, that also monitors your web browsing. Don't hesitate to read our Security for everyone series, where we review the latest antivirus products for Windows and Android devices. Top-notch antivirus products like Bitdefender, Kaspersky or ESET have safe browsers or banking and payment protection modules that you should use for this kind of transactions.

They might seem like a hassle at first but you won't regret using them. With the help of such security features, you are sure that your transactions are not intercepted by keyloggers or third parties that sniff your network traffic.

How to perform transactions from a computer connected to a public network

Personally, I avoid making any kind of financial transactions when connected to a public network. Free Wi-Fi can mean that someone is nearby, sniffing the traffic going through that network and you can also be the victim of man-in-the-middle attacks. If you must make financial transactions when connected to public wireless networks, pay special attention to the warnings given by the browser or your security suite. Modern desktop browsers are able to detect when someone tries to replace security certificates with fake ones and try to be the middleman between your computer and the websites that you visit. If your browser says certain certificates are invalid or your security suite reports anything suspicious, stop and disconnect from that network immediately. It is also good to change the passwords for the services you accessed via that network as soon as you get connected to a more trusted network.

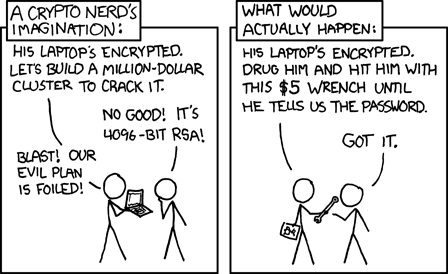

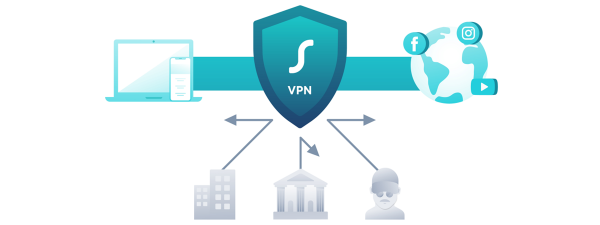

A great idea is to connect to a trusted VPN service that encrypts your network traffic, so that it is not easily intercepted by third parties. And even if it is intercepted, your traffic is encrypted and difficult to decrypt and make sense of it. Some security products like Kaspersky and F-Secure include VPN services in their Total Security suites.

Another recommendation is to use the features that are included in modern security suites which can run your browser in a safe box that's isolated from the rest of the operating system and make it harder to intercept what you you are doing. Some security products also encrypt the traffic that goes through that safebox, using their own VPN services.

Many people also use a mobile internet USB modem to connect when they are on the road. Using such connections is much safer than using random free Wi-Fi you know nothing about. If you can choose between the two, always make financial transactions using your own USB modem.

How to perform financial transactions from a public computer

Making transactions from a public computer is definitely NOT recommended. Public computers are used by many people who can install keyloggers and other forms of malware that you know nothing about. Also, they might not be secured with a modern antivirus product like the ones we review regularly on Digital Citizen. If you really must use a public computer to make financial transactions, we recommend the following:

- Use a free online antivirus scanner, like the ones we reviewed here, to scan it for malware. If threats are detected, don't use that computer for financial transactions of any kind.

- If there is a security product installed on it, double check that it is active or start it up yourself if needed.

- If more modern web browsers are installed, navigate the web using their private browsing features. Read this guide to learn how it's done: How To Browse The Web Incognito In All Major Internet Browsers. Such browsing modes guarantee that no history is stored and, as soon as you close the browser, all the cookies and the active sessions are gone. Other people won't be able to resume from where you left off.

- Pay attention to all the warning that you get from your web browser or the security product that it is installed on that public computer. If your browser says certain certificates are invalid or your security suite reports anything suspicious, stop using that computer.

- Do not allow the web browsers you are using remember the passwords that you type.

- Always log out from all websites you have logged in, prior to closing them.

How to perform financial transactions from a smartphone or tablet

If you need to do online banking from a smartphone or tablet, try not to use the mobile browser available. Mobile browsers are not as evolved from a security perspective as desktop browsers. Instead, install the banking application provided by your bank or the mobile application provided by the store that you are using. Such applications generally have good encryption and are safer to use on mobile terminals.

For the mobile platforms that have security suites available - always use them. Consider installing at least a trusted free security solution, if you can't afford a commercial one with more security features. Don't hesitate to read our Security for everyone series, where we review the latest antivirus products for Windows and Android devices.

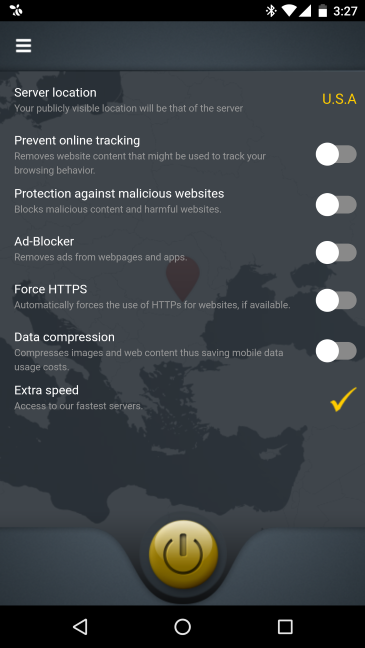

If you are connected to a public wireless network, you are vulnerable to man-in-the-middle attacks and network sniffing. A great idea is to connect to a trusted VPN service that encrypts your network traffic, so that it is not easily intercepted by third parties. And even if it is intercepted, your traffic is encrypted and difficult to decrypt and make sense of it.

Keep in mind that it is much safer to turn off the Wi-Fi on your smartphone or tablet and use your cellular connection with your mobile provider. Such connections tend to be safer and harder to sniff.

Pay attention to your passwords use

No matter where you make financial transactions from, stop using the same password for your e-mail account(s) and the accounts on websites where you perform financial transactions of any kind. Having the same password for your e-mail account and for your Amazon or PayPal account is a huge vulnerability.

Think of all the places where you make financial transactions and make sure that for each account you have a unique strong password. You will be surprised to see so many places are storing your credit card information. Here are just a few, to get you started with your thinking: Amazon, PayPal, Steam, Google Play Store, the App Store, the Windows Store, the PlayStation Network, GOG, eBay, the airlines you fly, Booking.com, the travel agencies with whom you book your vacations and so on. We highly recommend that you read this article on password use: Password Security - Turn Your Dumb Habits Into Geek Habits.

Conclusion

We hope that you found this article useful. If you have other tips and recommendations you would like to share, don't hesitate to share them using the comments form below.